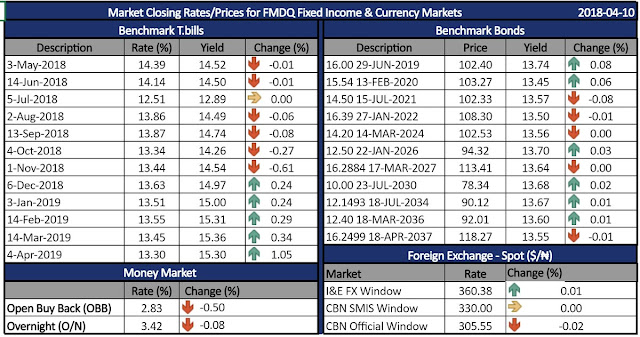

Status Quo At MPC Sign That Not Much Achieved In 2 Years

By Idialu Odegua Judith, judyodegua@yahoo.com The Central Bank of Nigeria (CBN), on Tuesday concluded its Monetary Policy Committee (MPC) meeting in Abuja and for the 12th consecutive time in two years, all the benchmark Monetary Policy Rate was retained. While there are noticeable improvements in economic indices, the continued maintenance of the status quo in rates leaves much to be desired than achieved in the period. Specifically, MPR was left at 14%; Cash Reserves Ratio (CRR), 22.5%; Liquidity Ratio, 30%, while the Asymmetric Corridor around the MPR stands at +200/-500 basis points. The major challenge within the period were how to counter risks of inflation, attract foreign investments and maintain exchange rate stability. Bond Meanwhile, trades at the nation’s Bond market closed on a flat note as investors awaited results of the day’s Bond auction, as it was expected to influence movement in yields in the OTC market. However, the Results from the bond auction show