Profit Taking Ahead, As Investors Await Results Of Interim Dividend Stocks

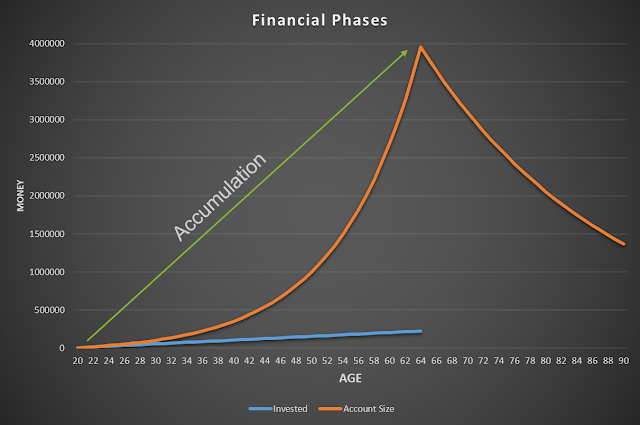

Market Update for the Week Ended August 7 And Outlook for August 10-14 Trading activities on the Nigerian Stock Exchange last week remained on the recovery path, extending the three consecutive weeks of bull-run and strong buying sentiments propelled by corporate earnings that beat investors’ expectations. This was despite the array of mixed numbers, rising cases of Coronavirus infection in the country, economy uncertainties and policies mismatch by the government. In the past week also, the Federal Government announced a hike in the price of Premium Motor Spirit (or petrol), in line with its decision to remove subsidy on the product, owing to incidences high level corruption, bringing the pump price to between N148.50 and N150 per litre, a factor that would further push up the cost of living and inflation. The better-than-expected half-year earnings reports submitted by many blue-chip companies and attractive valuation of equity assets in the prevailing low interest and yield environm...